Getting back in the London Open Groove.

Slammed a Red Bull and cranked up this https://www.youtube.com/watch?v=Zk26FUe38y0&t=9271s and "Talking Forex".

This got me so in the zone that I neglected to post anything here. Whoops.

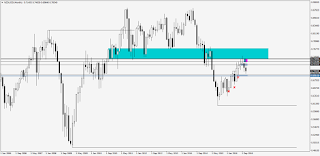

One trade went down today for me, GU sell.

GBPUSD was at a level I liked, so I copped a position.

Got my fill at the beginning of London.

After sideways consolidation into New York Open it became apparent what what happening - Distribution, the best case scenario for a sell. The trade hung around breakeven until about an hour and a half after NYO, then bam, bottom fell out of the distribution and we were well on our way to take profit during London Close.

Take profit was tapped during the London Close kill zone like clockwork.

Let's see what happens tomorrow.

Peace, yo